Karista is an early stage venture capital fund based in Paris, and it says that in the first quarter of 2022 there was some $4.75 billion (€4.7bn) of total new funding spread over 74 space technology deals.

The split in terms of cash allocation was that 41 percent was focussed on North America (and 30 deals), 38 per cent was in Europe (and 28 deals), 20 per cent was in Asia (15) and just 1 per cent in South America (1).

Karista says 36 per cent of the European total want to French agreements (10 deals), 29 per cent to the UK (8 deals), 11 per cent to Spain (3 deals) and 7 per cent to Germany (2 deals). Four per cent of the European total was divided between Portugal, Belgium, Switzerland, Italy and Finland.

As to where the cash went in terms of Seed, Series A, B, or C-stage funding Karista says 22 of the deals were for Series A funding (totalling $437 million) but the largest slice of funding ($2.7 billion) went on 16 deals classed as ‘Series C or beyond). However, some $757 million went on SPAC or IPO funding spread over 4 deals.

Karista says that the largest deals went to:

· Flexport (US, $935m)

· Satelogic (Uruguay, $262m)

· D-Orbit (Spain, $185m)

· Satixfy (UK, $230m)

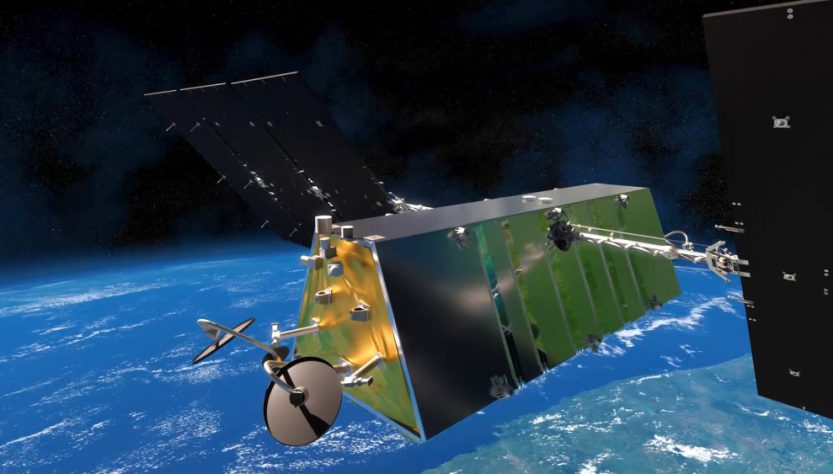

· Terran Orbital (US, $80m)

As to the types of space business that generated most interest, the report says that Orbital positioning and navigation won $2.1 billion of investment, while Earth Observation attracted $1 billion. Launch activity saw $599 million of activity.

Named companies busy in M&A included Israel’s Euclid System Engineering, SolAero Technologies of the US, Honeybee Robotics (US, bought by Jeff Bezos’s Blue Origin), Next4 (France), AXESS Networks of Spain and bought by Hispasat, and Leonardo DRS of the US bought by SES of Luxembourg.