WASHINGTON — Terran Orbital, a manufacturer and integrator of small satellites based in Boca Raton, Florida, announced Feb. 17 it won a contract from the U.S. military’s top contractor Lockheed Martin to produce and launch three spacecraft for a product demonstration.

Lockheed Martin is not only a customer of Terran Orbital but a longtime investor in the company. Tyvak Nano Satellite Systems, a satellite bus provider owned by Terran Orbital, is Lockheed Martin’s partner for the contract the latter won in 2020 to build 10 satellites for the Pentagon’s Space Development Agency.

Terran Orbital is one of many companies in the space industry going public through a merger with a blank-check company or SPAC (special purpose acquisition company). During a presentation to investors Feb. 17, executives said they expect the SPAC deal with Tailwind Two Acquisition Corp., announced in October, to be completed in the coming weeks.

The company is venturing into the public markets as space businesses that completed SPACs deals over the past year have seen their value drop precipitously as a result of broad selloffs and concerns about their timelines to profitability.

Terran Orbital executives noted that the company is pursuing commercial customers but is heavily weighted toward government work, and expects significant revenue from military and intelligence contracts.

“We have real revenues, and a real backlog.” said Terran Orbital CEO and co-founder Marc Bell. “Lockheed Martin is using Tyvak satellites for proposals to the United States government,” he said. “We can leverage the experience of the world’s largest government prime with the entrepreneurial spirit of a small company.”

Lockheed Martin’s latest order for three satellites is one of several that Terran Orbit has won over the past six months, valued at more than $170 million, according to the company. This includes multiple awards from government and commercial customers.

Bell in his pitch to investors said small satellites are “the future of space” and Terran Orbital is one of the few remaining independent manufacturers of small satellites. “Our competitors are owned by conglomerates. You can’t invest in them directly,” he said, referring to small satellite suppliers like Millennium Space Systems and Blue Canyon Technologies that in recent years were acquired by Boeing and Raytheon, respectively.

New SAR constellation

Terran Orbital has been reorganized into two business segments: Satellite Solutions and Earth Observation Solutions.

Satellite Solutions is absorbing Tyvak. Bell said the company is phasing out the name Tyvak because Terran Orbital is transitioning to larger satellites — ranging from 150 to 500 kilograms — and will no longer be making nano-satellites.

To boost its presence in the military market, Terran Orbital has hired a number of retired officers. The president of Satellite Solutions is Christian “Boris” Becker, a retired U.S. Navy rear admiral who ran the Navy’s space warfare command.

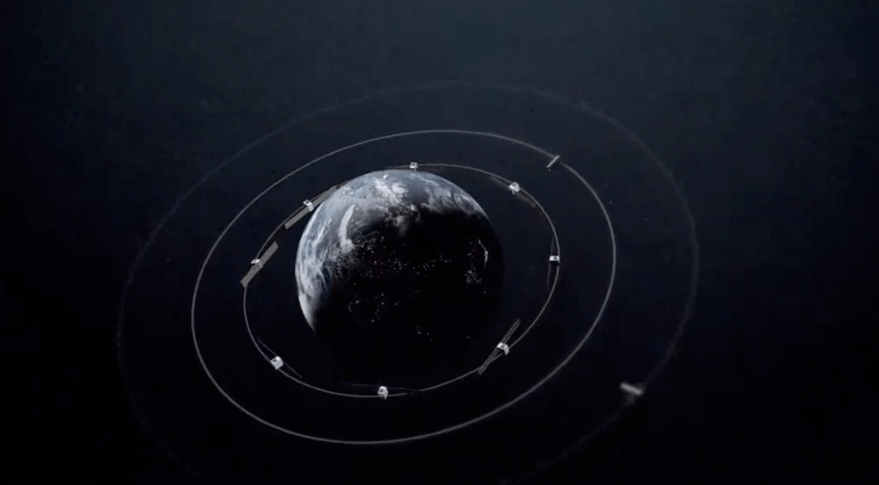

Earth Observation Solutions is the business that will oversee PredaSAR, a company created by Terran Orbital in 2019 with the goal of building a 48-satellite constellation of radar imaging spacecraft. The first satellite is projected to launch later this year.

Terran Orbital is manufacturing PredaSAR’s satellites in Irvine, California. It is also opening a new manufacturing plant near Cape Canaveral, Florida.

The U.S. military and the intelligence community will be PredaSAR’s primary customers, said Bell.

Roger Teague, a retired major general who ran strategic planning at U.S. Air Force Space Command; and Dave Mann, a retired lieutenant general who ran U.S. Army space and missile defense programs, told investors that they see a large demand across the U.S. military for synthetic aperture radar imagery.

Mann said the Army is the military’s largest user of SAR imagery. PredaSAR in December won a $2 million contract from the U.S. Space Force to demonstrate interoperability between its satellites and the Defense Advanced Research Projects Agency’s Blackjack constellation. And it is one of five SAR imagery providers selected last month by the National Reconnaissance Office for study contracts.

Teague said he expects these study contracts to lead to long-term procurement deals. “The government likes to adopt a crawl, walk, run approach towards building relationships with commercial providers.”